YouTube’s Popular Dominance

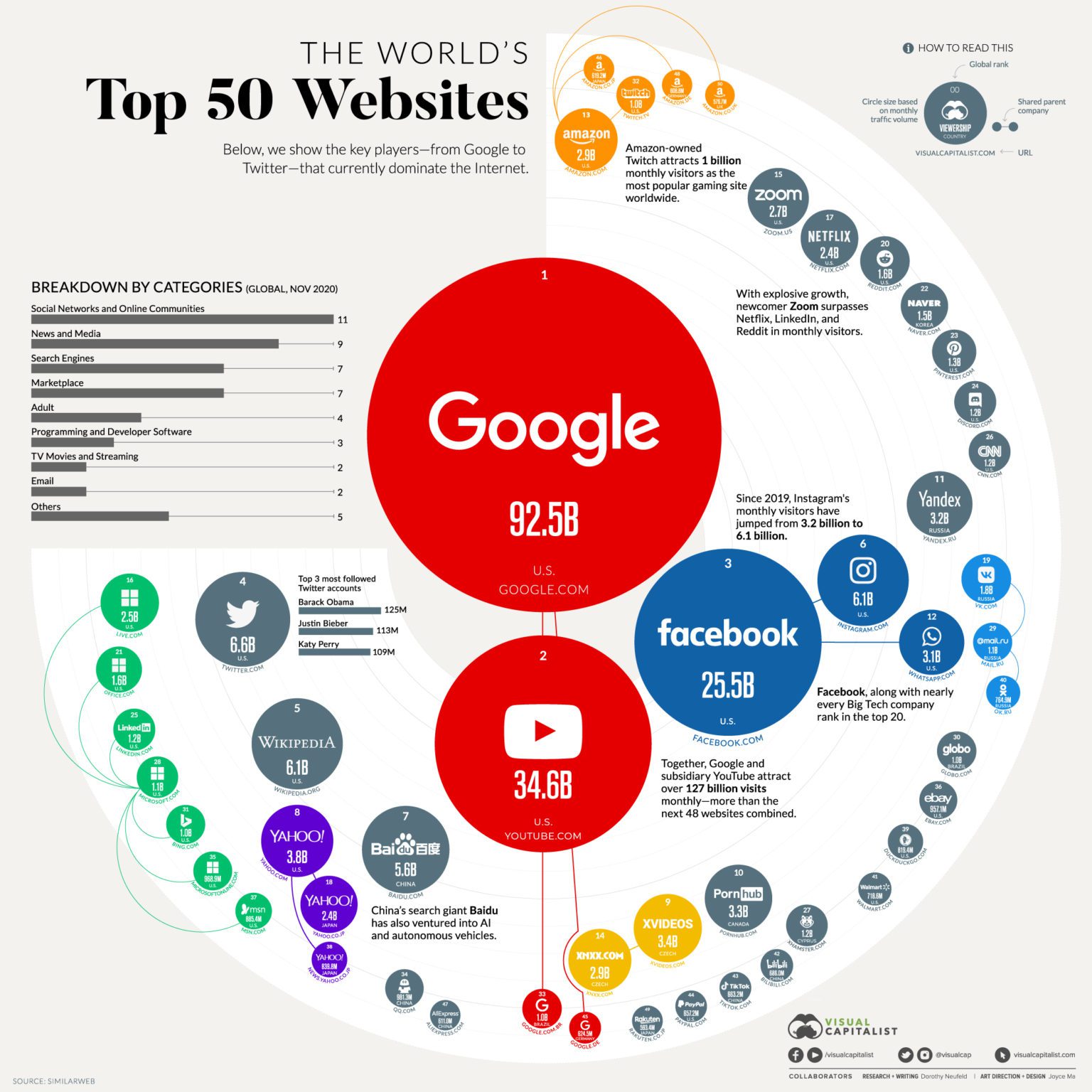

The following diagram ranks the top 50 websites by total average visits worldwide monthly [visualcapitalist].

YouTube.com was the second most popular with 34.6 billion visits. This was 37.4% as much traffic as the first most popular website – Google.com with 92.5 billion visits – and 135.0% as much traffic as the third most popular website – Facebook.com with 20 billion visits.

Together, YouTube and Facebook majorly dominate the market of (non-porn) public video hosting. The only entity that even comes close is the fourth and fifth most popular websites – Twitter.com with 6.6 billion visits and Instagram.com with 6.1 billion visits – which are 19.1% and 17.6% as much traffic as just YouTube.com respectively. Of course, Facebook.com, Twitter.com, and Instagram.com are not only centered around video content so this comparison to YouTube.com’s domain of video hosting is only partial.

In the same way that Google.com has dominated search and Facebook.com has dominated social media (debatable what “social media” means here), YouTube has dominated public video hosting.

YouTube’s Revenue Model

How does YouTube make money? According to YouTube, they makes money in two ways:

- Payments from advertisers in return for hosting ads on most YouTube videos

- Payments from subscribers to YouTube Premium in return to access to exclusive content funded by YouTube

The vast majority of YouTube’s revenue comes from advertising [citation needed].

YouTube’s Network Effects

Independent video creators (or just “creators” for short) create the vast majority of content of YouTube. Even the YouTube Premium content is usually made by creators that started out like anyone else and built an audience over years of producing publically-available videos on YouTube.

In order for YouTube to be such a popular site, it needs to have a large amount and variety of content that appeal strongly to many different kinds of users. With such a huge creator base producing content, YouTube clearly meets this demand. The network effect here is that new creators that are considering where to publish their content are more attracted to YouTube the more users are there to watch their content, and new users that are considering where to look for content are more attracted to YouTube the more creators publish their content there. This virtuous cycle results in YouTube gaining a massive advantage over competitors, as any small starting differential in users and creators between YouTube and competitors in the past grows much larger over time as the advantage accumulates due to the increasing returns (as opposed to diminishing return) aspect of network effects with respect to gaining new users and creators.

How could a new competitor possibly compete with YouTube with this dynamic persisting?

Competing with YouTube

To decide a measure for competativeness with YouTube, first specify respects to which the competitor would like to compete with YouTube. This could be all respects where the competitor is better in every way, or a selection of respects where the competitor does not compete for all of YouTube’s market but can still gain an advantage in a submarket.

Some example respects:

- Attractiveness for creators

- Quality content

- Curated content

- Personalized/commissioned content

- TODO: more respects

Many of these are already approved upon from YouTube by websites such as:

- Vimeo, etc. allows a creator to put their videos on sale for a chosen prices so that users can directly buy access to individual videos.

- Patreon, etc. simplfies the process of a creator receiving support directly from fans, and allows a creator to gather a personalized community and sell commisioned content to patrons.

- Netflix, Hulu, etc. offer quality, curated, long-form content (movies and TV shows) for a fixed subscription price with (usually) no advertisements.

- Twitch, etc. offer specialized livestreaming services and audience interaction.

- TODO: more examples

Apparently, there still is some diverse competition among specific sub-markets of public video hosting, even if YouTube dominates the most generic case and, even combined altogether these submarkets probably do not match half of YouTube’s popularity (by average views).

So, is there some clear inefficiency in this state of affairs where a new competitor should be able to compete with YouTube more directly? Or are there good reasons why competition should focus on these more niche markets rather than try to compete for YouTube’s creators and users in general?

YouTube’s General Advantage

A major respect to which no public video hosting service seems to compete well with YouTube on is sheer scale. As of February 2020, YouTube announced that about 720 thousand hours of video are uploaded to and 1 billion hours of video are watched on YouTube each day. [Blog.Youtube: YouTube at 15]. No other platform, not even Facebook, comes close to handling the size of that data being transmitted at that rate (as of 2018, Facebook serves about 100 million hours of video content each day) [Yansmedia: Facebook Video Statistics].

Video is the highest-bandwidth media popularly consumed: they are very large (being a long collection of images) and are consumed fast. Hosts and browsers have even adopted special support for buffering specifically to allow viewing to be possible in HTML. To facilitate such high-bandwidth hosting at such a large scale, a provider needs to have very distributed (for robustness and mitigating latency) and powerful infrastructure.

Google (which owns YouTube and sustained it when it was popularly thought that YouTube might not have a sustainable business model [Wikipedia: History of YouTube]) has developed a huge advantange in these aspects through its array of datacenters [datacenterfrontier]. Building these datacenters is an huge activation cost [Wikipedia: activation energy]. When Google bought YouTube, it kickstarted its popularity by expanding this infrastructure in order to increase capacity, which ultimately facilitated the increasing returns of network effects that played such a large part in building YouTube’s dominance today. Without access to Google’s capital, YouTube the start-up might not have been able to afford or judge worthwhile the risk of investing in the infrastructure that was so important for its success.

Today, the activation costs are higher and lower in different ways:

- The costs of hosting content online is much lower due to better access to third-party, business-oriented content hosting services. However, these services are more costly on margin than owning the infrastructure yourself, so in the long-run take a deep cut into overall profits.

- With YouTube as an existing and hugely dominant market player, a new competitor needs to overcome YouTube’s advantages. Since YouTube is basically free for users and creators, it is diffuclt to undercut its prices (although, they can still be undercut by paying more to creators and even users). A competitor would need to appeal to a submarket, as mentioned in the Competing with YouTube section earlier.

- It is much easier for new competition to get noticed on today’s internet as opposed to the internet of 2006 when there were many fewer users and much worse ability to share links to content. Online advertisement is easier and more efficient than ever.

- TODO: more ways

Predictions

In the next 10 years, I expect:

-

Activation costs for undercutting YouTube with a generally better service are too high and have too low expected returns to expect it to be accomplished successfully anytime soon. YouTube will maintain a huge dominance in general public video hosting, but its dominant share of traffic will be roughly stable.

-

The submarkets of public video hosting will become more prominent, and start to eat away at YouTube’s user/creator base. YouTube will still be the home for random homemade content and newly independent creators, but a variety of other platforms will attract away creators with features cater to their specific kinds content. Creators can will make their start on YouTube, but usually migrate to other platforms once they find a content niche. This will be facilitated by a drop in the effective cost of using alternative platforms due to an homogenizing of user interfaces and sharing methods.